When you need financial help, knowing how long it takes to get a loan is key. Mariner Finance is known for quick loan approvals. We’ll look at how Mariner Finance handles loan applications and what affects approval time.

Key Takeaways

- Mariner Finance’s loan approval process can vary depending on the type of loan and your individual financial profile.

- Understanding the documentation required and pre-qualification steps can help streamline the application process.

- Factors such as your credit score, income verification, and document completeness can influence the speed of your loan approval.

- Comparing online and in-person application processing times can help you determine the best approach for your specific needs.

- Familiarizing yourself with the standard processing timeframes for different loan types can set realistic expectations.

Understanding Mariner Finance’s Loan Application Process

Getting a loan from Mariner Finance is easy. It follows a clear mariner finance application timeline and mariner finance lending process. First, you need to meet some basic requirements. Then, gather your documents and go through pre-qualification. Let’s look at the details.

Initial Application Requirements

The first step is to give some basic personal info. This includes your name, address, and contact details. You also need to say why you need the loan and how much you want.

Documentation Needed for Processing

After you apply, Mariner Finance will ask for more documents. You might need:

- Proof of income (like paystubs or tax returns)

- Identification documents (like a driver’s license)

- Details of any debts or loans you have

- Info about any collateral (if it’s a secured loan)

Pre-qualification Steps

Mariner Finance will then review your financial situation. They’ll check your credit and income. They might ask for more info or clarify things during this time.

Knowing the mariner finance application timeline and mariner finance lending process helps. It prepares you for your loan application. This way, you can increase your chances of a smooth approval.

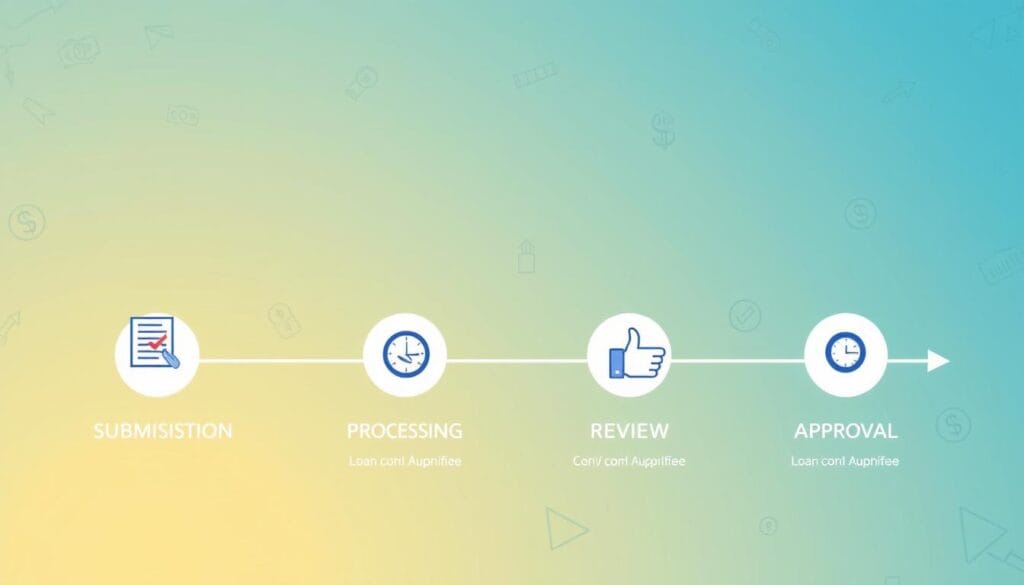

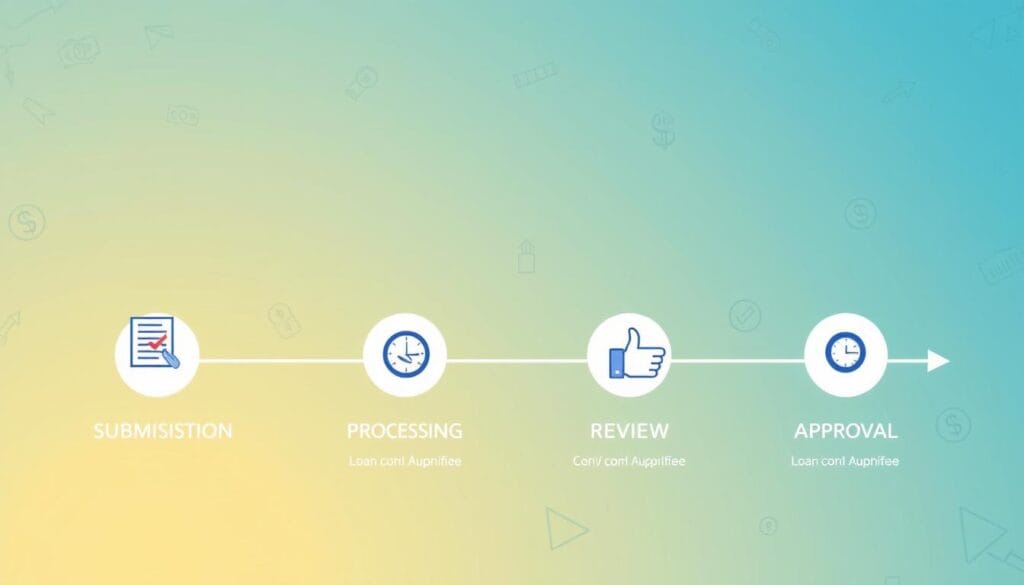

How Long Does Mariner Finance Take to Approve Loans: A Complete Timeline

Are you thinking about getting a loan from Mariner Finance? You might wonder, “How long does Mariner Finance take to approve loans?” The time it takes can change based on different things. But, this detailed timeline will help you understand the usual steps in getting a loan approved.

When you apply for a loan with Mariner Finance, the review starts right away. The lender checks your credit score, income, and other financial details to see if you qualify. This first step can take 1 to 3 business days.

After you’re pre-qualified, you need to give more documents. These include pay stubs, bank statements, and ID. Reviewing these documents can take 2 to 5 business days. This depends on how complex your financial situation is and how complete your documents are.

Once your documents are checked and confirmed, Mariner Finance moves to the underwriting stage. Here, they deeply look at your financial situation to decide on your loan. This step can take 3 to 7 business days. It depends on the loan amount and your application’s details.

If your loan is approved, the final step is the closing. This can take 1 to 3 business days. You’ll sign the papers and get the loan money here.

In total, the typical Mariner Finance loan approval timeline can range from 7 to 18 business days. This depends on how complete your application is, how complex your finances are, and any extra checks needed.

This timeline is just an estimate. Your experience might be different. Things like the loan type, your credit score, and how many applications Mariner Finance is handling can affect the time it takes. Knowing this process helps you prepare and manage your expectations when applying for a Mariner Finance loan.

Factors Affecting Your Loan Approval Speed

Getting a loan from Mariner Finance can be fast or slow, depending on a few things. Knowing these can help you get through the application quicker. This way, you might get a mariner finance credit decision speed that’s faster.

Credit Score Impact

Your credit score is very important to Mariner Finance. People with better scores get loans faster because they’re seen as safer. Make sure your credit report is right and try to improve your score to speed things up.

Income Verification Timeline

How fast Mariner Finance can check your income also matters. They need things like pay stubs or tax returns to see if you can pay back the loan. Giving them these documents quickly can make the approval process faster.

Document Completeness

Having all your documents ready and in order can really help. If something is missing, it can slow things down. So, make sure you have everything needed and that it’s correct to avoid delays.

| Factor | Impact on Approval Speed |

|---|---|

| Credit Score | Higher scores lead to faster approval |

| Income Verification | Prompt document submission accelerates the process |

| Document Completeness | Complete and organized files reduce processing time |

By knowing these important factors and taking steps to improve them, you can get your loan faster. This way, you can get the money you need more quickly and efficiently.

Online vs In-Person Application Processing Times

Choosing how to apply for a loan with Mariner Finance is up to you. You can apply online or visit a local branch. Each method has its own benefits, and knowing the processing times can help you decide what’s best for you.

The Convenience of Online Applications

Applying for a mariner finance loan online is quick and easy. You can fill out the application from home or work. This saves time and lets you avoid scheduling a meeting.

This option is great for those with tight schedules or who like to apply at their own pace. It’s all about convenience.

The Benefits of In-Person Interactions

While online applications are convenient, some people like the personal touch of visiting a branch. At a branch, you can talk one-on-one with a loan specialist. They can offer insights and help with the mariner finance loan decisioning timeframe.

This face-to-face interaction is perfect for those with questions or who need extra help. It’s a chance to get personalized guidance.

| Feature | Online Application | In-Person Application |

|---|---|---|

| Convenience | High | Moderate |

| Processing Time | Typically Faster | Potentially Slower |

| Personal Guidance | Limited | Comprehensive |

The choice between online or in-person mariner finance application depends on you. Consider your preferences, schedule, and financial needs. By looking at the pros and cons, you can choose the best option for you.

Standard Processing Timeframes for Different Loan Types

When you’re thinking about a loan from Mariner Finance, knowing the typical processing times is key. The time it takes to get your loan approved can change based on the loan type. Let’s explore the usual processing times for personal, secured, and home improvement loans.

Personal Loans Processing

Personal loans at Mariner Finance are processed quickly. Most applications are approved in 1-2 business days if you provide all needed documents. This fast process means you can get the funds you need without waiting too long.

Secured Loans Timeline

Secured loans, backed by your vehicle or other assets, take a bit longer. This extra time is for checking the collateral’s value and ownership. Usually, it takes 3-5 business days to process and approve these loans.

Home Improvement Loan Duration

Home improvement loans at Mariner Finance might take longer. They need more detailed documents, like project plans and cost estimates. On average, it takes 5-7 business days to process these loans.

Keep in mind, these times are general, and your loan approval might vary. Giving complete and accurate info early can speed up the process. This helps get your loan approved faster.

Knowing the usual processing times for different loans helps plan better with Mariner Finance. The secret to a quick loan approval is to have all documents ready from the start.

Tips to Speed Up Your Mariner Finance Loan Approval

Getting a loan approved can feel like a race. But, there are ways to speed up your Mariner Finance loan approval. Here are some tips to help you get your funding faster.

- Gather all required documentation upfront: Make sure you have all needed papers like pay stubs and bank statements before applying. This avoids delays later on.

- Respond promptly to requests: If Mariner Finance asks for more info, answer quickly. Fast responses can really help speed up the process.

- Maintain open communication: Keep in touch with your Mariner Finance rep. Reaching out can help find and fix any issues quickly.

- Ensure application accuracy: Check your application for mistakes. Fixing errors early can prevent delays.

- Consider an in-person application: Applying in person might be faster than online. It can help speed up the review and decision-making.

By using these tips, you can how long does mariner finance take to approve your loan faster. Being proactive and organized can really help with mariner finance approval time.

| Tip | Description |

|---|---|

| Gather all required documentation | Have all needed papers, like pay stubs and bank statements, ready before applying. |

| Respond promptly to requests | Give any extra info or clarification asked by Mariner Finance right away. |

| Maintain open communication | Keep in touch with your Mariner Finance rep and check on your application status often. |

| Ensure application accuracy | Double-check your application for mistakes to avoid needing to fix them later. |

| Consider an in-person application | Applying in person might be faster than online and can speed up the process. |

By following these tips, you can make your Mariner Finance loan approval faster. Being proactive and organized can really help with mariner finance approval time.

Common Reasons for Delayed Loan Processing

Going through the mariner finance lending process can be easy. But sometimes, loan applications face delays. Knowing why these delays happen can help you prepare better. This way, you can get your turnaround time for mariner finance loans faster.

Missing Documentation Issues

One big reason for delays is missing documents. Mariner Finance needs certain info and papers to review your application well. If you don’t give them everything they need, like proof of income or ID, they might ask for more. This can make the process take longer.

Verification Challenges

Checking if the info you give is correct is key in the mariner finance lending process. If Mariner Finance has trouble checking your job, income, or other important stuff, they might have to do more checks. This can make the turnaround time for mariner finance loans longer.

Technical Delays

Technical problems, like system failures, can also slow down the mariner finance lending process. Mariner Finance works hard to keep things running smoothly. But sometimes, technical issues can cause delays in getting your loan approved.

Knowing why loans might be delayed can help you avoid problems. By talking openly with Mariner Finance and giving them all the documents they need, you can speed up your loan approval. This way, you can get your turnaround time for mariner finance loans faster.

What Happens After Loan Approval

After Mariner Finance approves your loan, the next step is getting the money. This usually takes 1-2 business days. The loan amount will then be put directly into your bank account. This quick action lets you use the funds right away to reach your financial goals.

Mariner Finance will tell you when and how much to pay each month. They offer flexible payment plans to fit your budget. You can also set up automatic payments to make sure you never miss a payment. You’ll get updates on your loan and payments regularly, helping you manage your finances well.

At times, Mariner Finance might ask for more information to complete your loan. This could be insurance details, property appraisals, or other verification. The Mariner Finance team will help you with any extra steps needed. They aim to make the process smooth and clear from start to finish.

FAQ

How long does Mariner Finance take to approve loans?

Mariner Finance usually decides on loans in 1-2 business days after they get your application. The whole process can take a few days to a couple of weeks. This depends on the loan type and your financial situation.

What is the loan application process like with Mariner Finance?

Applying for a loan with Mariner Finance has a few steps. First, you fill out the initial application. Then, you provide needed documents like proof of income and ID. After that, they check your creditworthiness. They aim to make a decision quickly.

What factors can affect the speed of my Mariner Finance loan approval?

Several things can affect how fast you get approved. Your credit score, how complete your application is, and the loan type matter. Those with good credit and complete applications usually get approved faster.

How do Mariner Finance’s online and in-person application processing times compare?

Online applications are usually faster than in-person ones. The online process is quicker and more straightforward. In-person applications might take longer because of extra steps like document submission and review.

What are the standard processing timeframes for different loan types at Mariner Finance?

Mariner Finance has different loans with varying approval times. Personal loans are the quickest, often approved in 1-2 business days. Secured and home improvement loans might take 3-5 business days because they need more checks.

How can I speed up my Mariner Finance loan approval?

To get your loan approved faster, have all needed documents ready. Answer any questions quickly and make sure your application is correct. Applying online can also make things faster than applying in person.

What are some common reasons for delayed loan processing at Mariner Finance?

Loans can be delayed for a few reasons. Missing or incomplete documents, income or job verification issues, and tech problems with the application system are common causes. Fixing these can help avoid delays.

What happens after my Mariner Finance loan is approved?

After approval, you finalize the loan details and sign the papers. Then, you get the money. The lender will tell you about repayment, any extra steps, and when you’ll get the funds.